how much does the uk raise in taxes

Before it was elected in 2019 the government promised not to raise the rates of the three biggest taxes - income tax National Insurance or value added tax. For example 20 hours of test prep in person could cost anywhere from 1000 to 2500 Pritchett continued.

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Looking next at VAT returns a one-off for a company taking between 0 to 100000 per year.

. Annual real estate taxes. Agents with more than 20 years of experience may see a pay raise up to 60000 per year. The standard rate of VAT increased from 175 to 20 on 4 January 2011.

If you choose to have online courses you could spend something like 200 to 600 for the same amount of time. Democrats say the legislation will raise close to 740 billion in tax revenue over the next 10 years and devote 300 billion of that money toward reducing the federal deficit. UK Bond Market Braces for More Losses After Trusss Energy Plan.

The UKs nationwide tax on sugar sweetened beverages SSBs saw a 10 decrease in sugar consumption in the first year alone. UKs Felixstowe Port Says Union Turned Down 8 Raise. The report notes that In every individual coalfield the job density the ratio between the number of jobs in the area and the number of working age residents is below the UK average.

What Does the Law Do. Disputing errors to your credit bureau helps raise your credit score. The UK Treasury forecasts as much as 170 billion of profit for gas producers and electricity generators over the next two.

How much does waiting raise your Social Security benefits. As you can see the specific amount of your benefits increase will depend on how long you wait after the age of 62 to claim your benefits. A fat 153 per cent 195 a year goes on environmental and social costs.

The top one per cent pay 30 per cent of all income tax revenues. SSB sales stayed the same but the amount of sugar in those drinks decreased as manufacturers reformulated their recipes to be able to sell their products at a competitive price point. How much taxesduties will be calculated to pay.

How has VAT changed over time. Joe Manchin does a Full Ginsberg and appears on ALL five major Sunday news shows to insist his spending bill will NOT raise taxes and REFUSES to back Biden for a second term. Siddharth Vikram Philip Follow.

If the government chooses to raise taxes as part of its response to the COVID-19 crisis it should implement a one-off wealth tax in preference to increasing taxes. The one-off cost can raise to 600 and beyond. Dedicate at least a year to improve your rating.

In economics the Laffer curve illustrates a theoretical relationship between rates of taxation and the resulting levels of the governments tax revenueThe Laffer curve assumes that no tax revenue is raised at the extreme tax rates of 0 and 100 and that there is a tax rate between 0 and 100 that maximizes government tax revenue. He also cut the amount the UK. Manchin and Schumers 433 billion Inflation Reduction Act would RAISE taxes on Americans making less than 400000 a year - and break Bidens promise of only targeting the ultra-wealthy study.

Credit Reference Agency Information Notice CRAIN Version. In one respect the UK tax system already looks top heavy. How Much Does an Accountant Charge.

Credit scores may take 12 to 24 months for improvements to reflect. I too am resident uk but have boight a property in Italy and would like to move some furniture dvds iMac old books and framed pictures over. A senior-level enrolled agent with between 10 and 20 years of experience can typically expect to earn an average salary of 55000.

Of this green stealth taxes represent a significant factor. Small business insurance costs anywhere from about 14 to 124 a month depending on which types you buygeneral liability commercial property business interruption insurance inland marine. Truss was asked if shed make a read my lips promise not to raise taxes in government a reference to a famous pledge made -- and then broken -- by former US President George H.

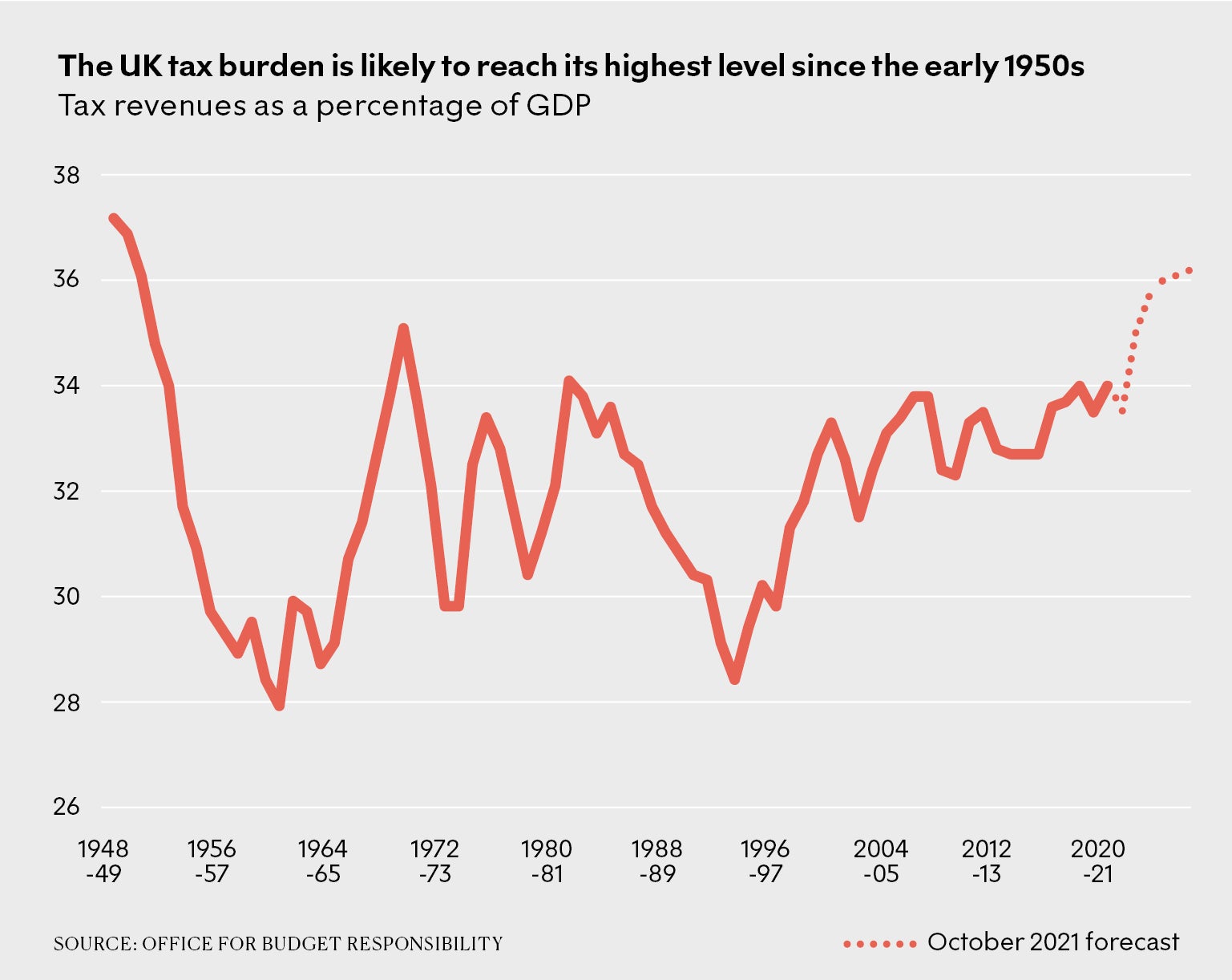

A higher share than at any time in past twenty years. They know the ins and outs of the 17000 pages of UK tax law and can go through your business expenses with a forensic eye identifying each money-saving area. 22 VAT and they need the codice fiscale to raise the import duty bill.

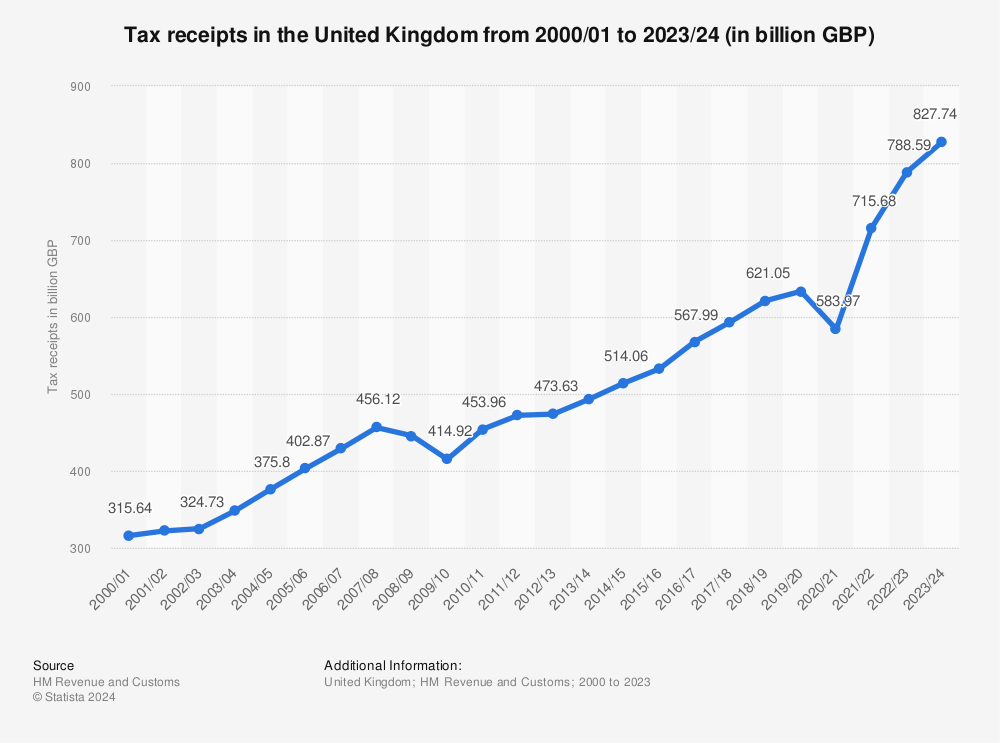

Despite those specific considerations though you can see that typical folks making 100000 pay roughly 5 to 15 of their income to the IRS in taxes with single filers bearing a much larger brunt. Daily Mail UK by Katelyn Caralle Original Article. These three taxes together raise more than half of government tax receipts.

In Fife and Falkirk in Scotland for example 157 of adults are out-of-work and reliant upon benefits compared to the UK average of 109. On electricity bills alone its a huge 255. March 3 2022 at 118 pm.

It S Time To Love Payroll This September Details Here Https Fmpglobal Co Uk Blog Its Time To Love Payroll This September Utm Cam Payroll Taxes Payroll Blog

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Sources Of Us Tax Revenue By Tax Type 2022 Tax Foundation

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

The Liberal Democrats Are Prepared To Raise Taxes To Fund An Nhs That Meets The Needs Of Everyone The Party S A Health Research Future Jobs Health Economics

Did Onondaga County Residents Win Or Lose In First Year Of U S Income Tax Reform First Stats Are In Income Tax Onondaga County Income

The Legacy Of The 2001 And 2003 Bush Tax Cuts Center On Budget And Policy Priorities

How Do Taxes Affect Income Inequality Tax Policy Center

Britain We Need To Raise Your Taxes Ifunny Stupid Funny Stupid Memes Really Funny

2022 Corporate Tax Rates In Europe Tax Foundation

The Rise Of High Tax Britain New Statesman

Average U S Income Tax Rate By Income Percentile 2019 Statista

How To Pay Taxes On A Credit Card And Get Rewards Business Credit Cards Credit Card Payoff Plan Credit Card